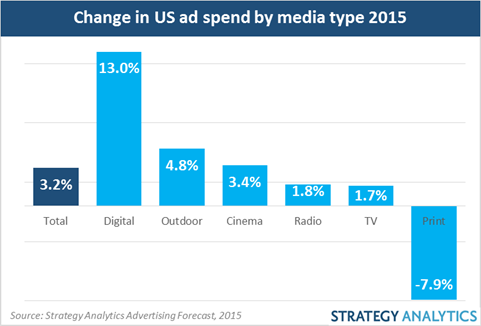

Online will grow the most in 2015 (13%) while print declines by 7.9%

Boston, MA – January 20, 2015. Driven by digital, advertising spend in the U.S. is predicted to grow 3.2% in 2015 to $186.6 billion, according to the latest Advertising Forecast from Strategy Analytics.

Digital will be the fastest growing ad format (up 13.0% year-on-year) followed by outdoor (up 4.8%) and cinema advertising (3.4%). Radio (up 1.8%) will also grow faster than TV (1.7%) whilst print will be the only ad format to see a year-on-year decline in revenue (down 7.9%).

Outdoor, cinema and radio are the only formats to grow faster in 2015 than in 2014. Despite this, traditional media revenues, overall, will be 0.2% lower in 2015 than 2014.

“Digital ad growth will be driven mostly by social media (31% growth), video (29%) and mobile (20%), although search will still command nearly 45% of digital ad revenues in 2015,” said Strategy Analytics’ Michael Goodman, co-author of the report.

“Despite digital’s best efforts, the drop in traditional ad revenues means we’ll see fairly modest growth in overall U.S. ad revenues in 2015 and will have to wait for more significant growth in 2016, courtesy of the U.S. presidential elections and summer Olympics.”

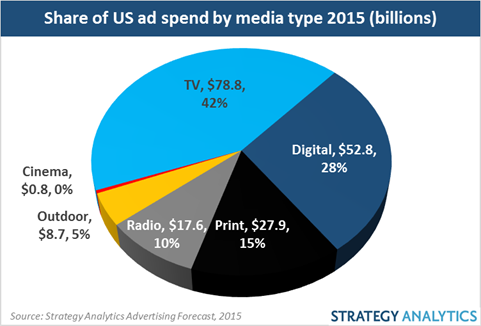

Size and share

TV will remain the biggest ad format in 2015, accounting for 42.2% ($78.8bn) of U.S. ad revenues, followed by digital, 28.3% ($52.8bn), and print at 14.9% ($27.9bn). Radio ($17.6bn), outdoor ($8.7bn) and cinema ($0.8bn) will account for the remaining 14.6%.

Compared to 2014, TV’s share will be down -0.6%, digital up 2.5% whilst print’s share will decline 1.8%. Share for the other formats will remain relatively unchanged.

Leika Kawasaki, co-author of the report says, “By 2018, TV’s share of ad revenue will fall to 40% whilst digital’s will have grown to 35%. However, TV’s declining share is less about ad dollars flowing out of TV and more about dollars flowing into digital from print and radio. TV networks such as ABC, NBC, MTV and the like will see little, if any, real decline in revenues, just a shift in the source from linear TV ads to online video.

“Print will be the major casualty, falling to $20.3bn by the end of 2018 – less than a third of its 2007 level – accounting for just 10% market share.”